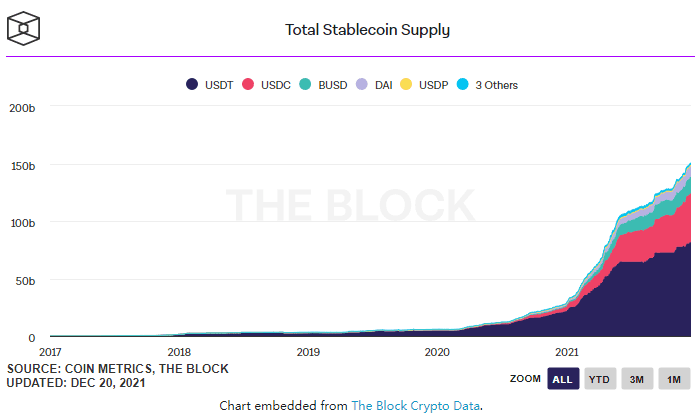

According to the data compiled by The Block Research, the "stable currency" market linked to the US dollar has experienced a rapid growth of 388% in 2021. It pointed out in the "2022 Digital Assets Outlook" report that the total supply of "stable coins" has surged from 29 billion U.S. dollars in early 2021 to more than 140 billion U.S. dollars. This trend has benefited a large number of "stable coins" represented by Tether (USDT) and USD Coin (USDC), the latter being managed by consortia including Circle and Coinbase.

Behind the surge in the supply of "stable coins", there are a number of different factors that work together to promote it. For crypto asset trading companies, this type of stable currency is regarded as a long-term response to the fluctuation of different cryptocurrency transactions.

In 2021, retail traders will put "stable coins" on the decentralized (DeFi) financial protocol as a means to make huge profits, in addition to the tailwind growth of the derivatives market.

Paolo Ardoino of Tether pointed out that in most derivatives situations, futures contracts are settled in "stable currencies." At the same time, The Block Research also mentioned that the market will face more regulatory scrutiny in 2021.

Circle CEO Jeremy Allaire predicts that 2022 is expected to be the year of transition for "stable coins." As more and more institutions and individuals want to hold "stable coins", it is expected to generate demand in this area on a global scale.

Finally, in addition to the needs of centralized (CeFi) and decentralized (DeFi) financial services, the application of "stable coins" in other fields is also expanding.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!