Several months ago, investors facing FOMO – the fear of missing out – worried that the ship had sailed when it came to crypto. Now, however, while that ship may have left the harbor, the wind is out of its sails as it floats directionless for the time being. Perhaps it’s because of upcoming Fed tightening; enthusiasm seems to have dampened. That sentiment is backed up by some market data showing market activity has fallen and that could take prices with it.

1. Funding rates have gone negative.

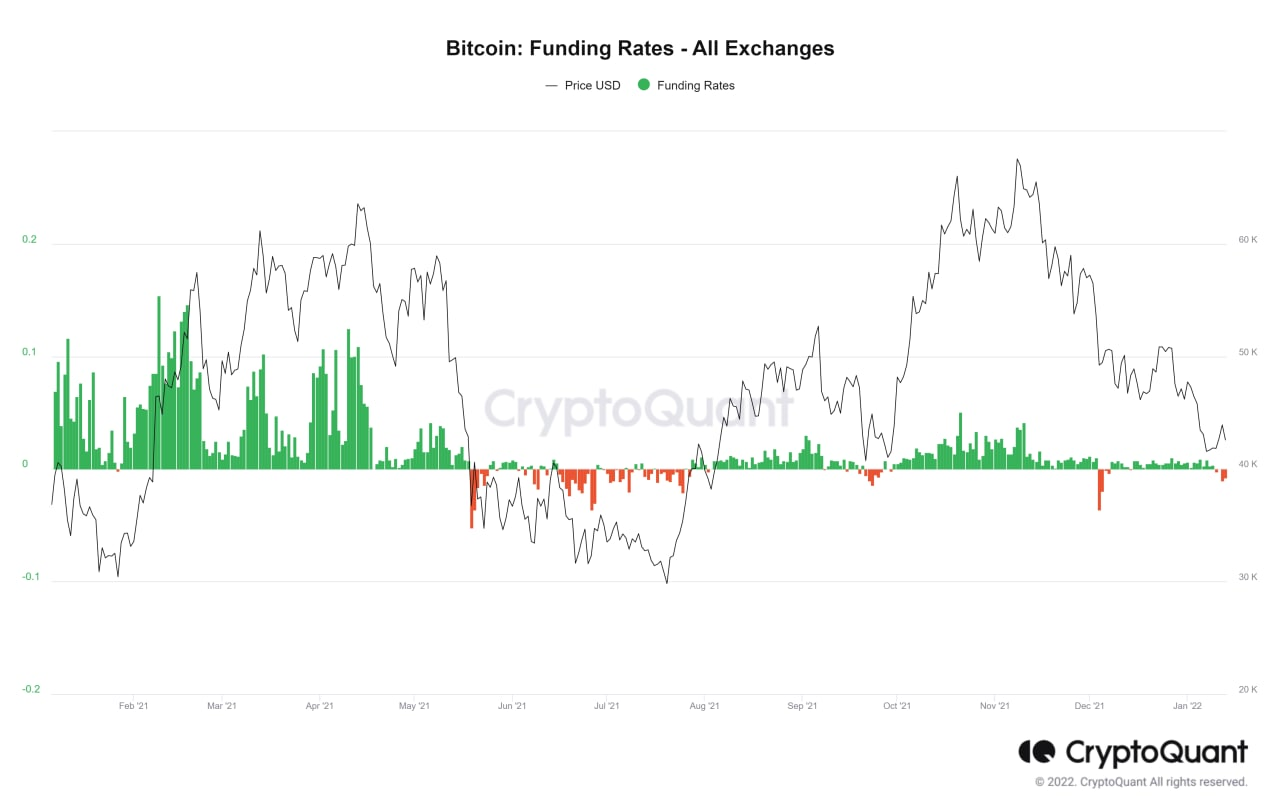

Bitcoin Funding Rates vs. Price (via CryptoQuant.com)

Rates from several major exchanges compiled by analytics firm CryptoQuant show that the cost of borrowing to buy crypto on leverage has fallen to the point where it’s slightly negative. That implies that demand for money to make leveraged bets has taken a hit. Traders aren’t in any rush to add to their positions.

2. Open interest (OI) in bitcoin futures is down slightly since the last week of December.

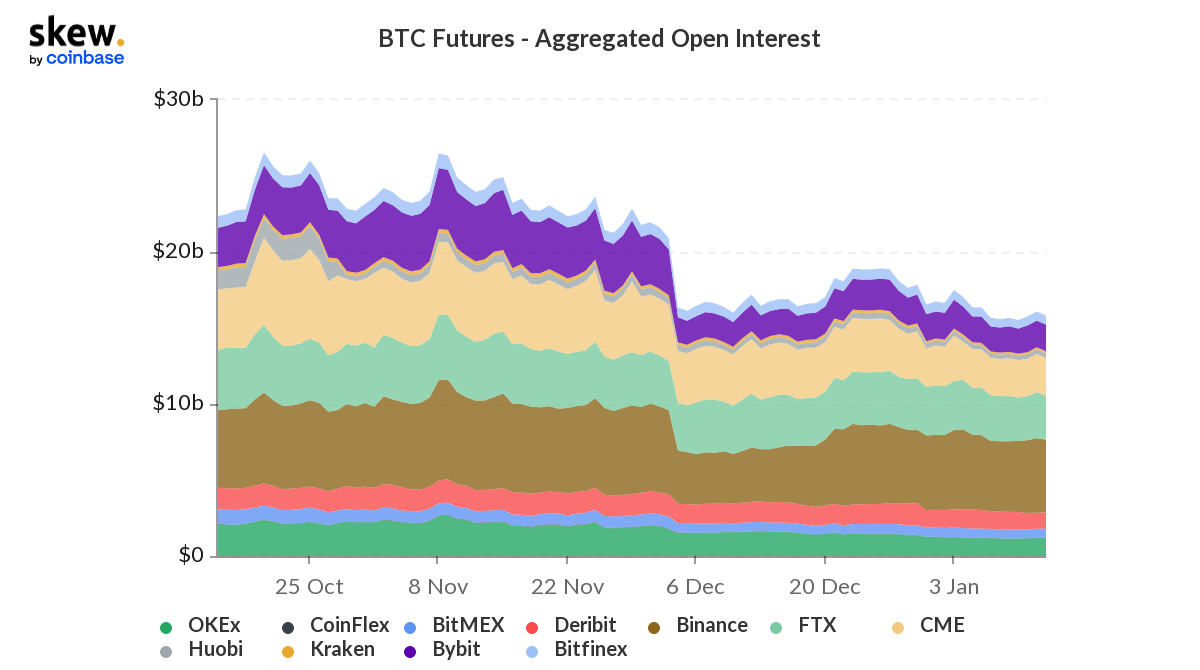

Bitcoin Futures Open Interest (via Skew.com)

It’s currently $16 billion, according to data site Skew.com, down from just shy of $19 billion around Christmastime. During bitcoin’s November peak, open interest was roughly $26 billion.

3. Ether futures also have seen declining open interest.

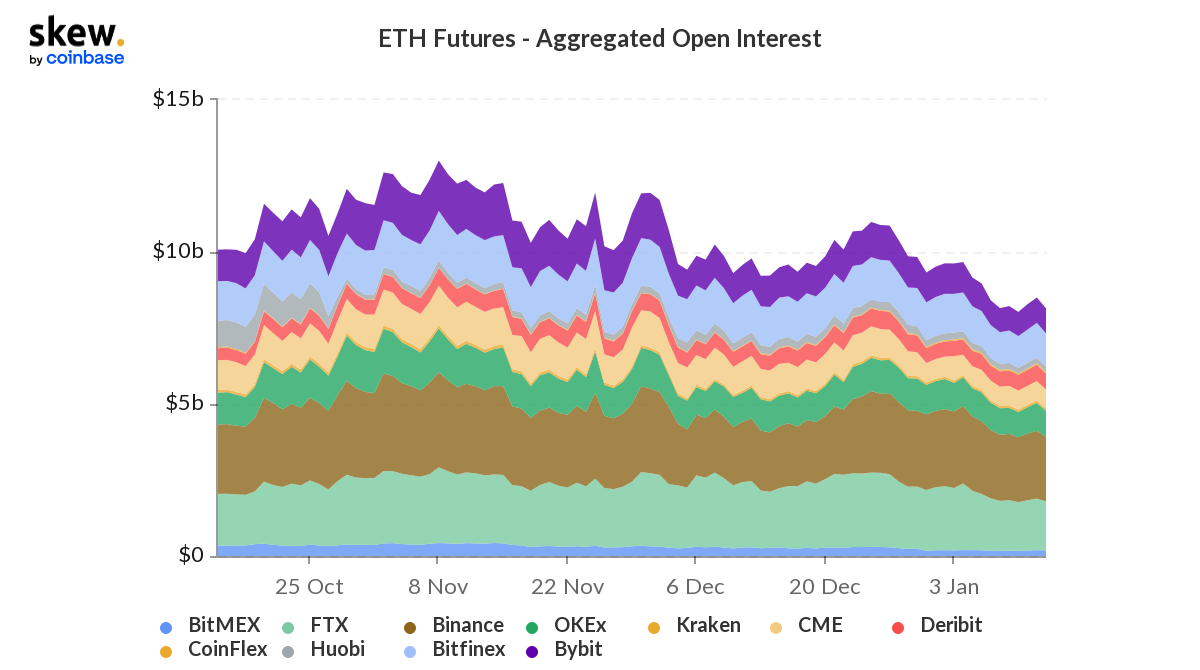

Ether Futures Open Interest (via Skew.com)

Since its own November peak of $13 billion, open interest for the smaller ether futures market is currently around $8 billion.

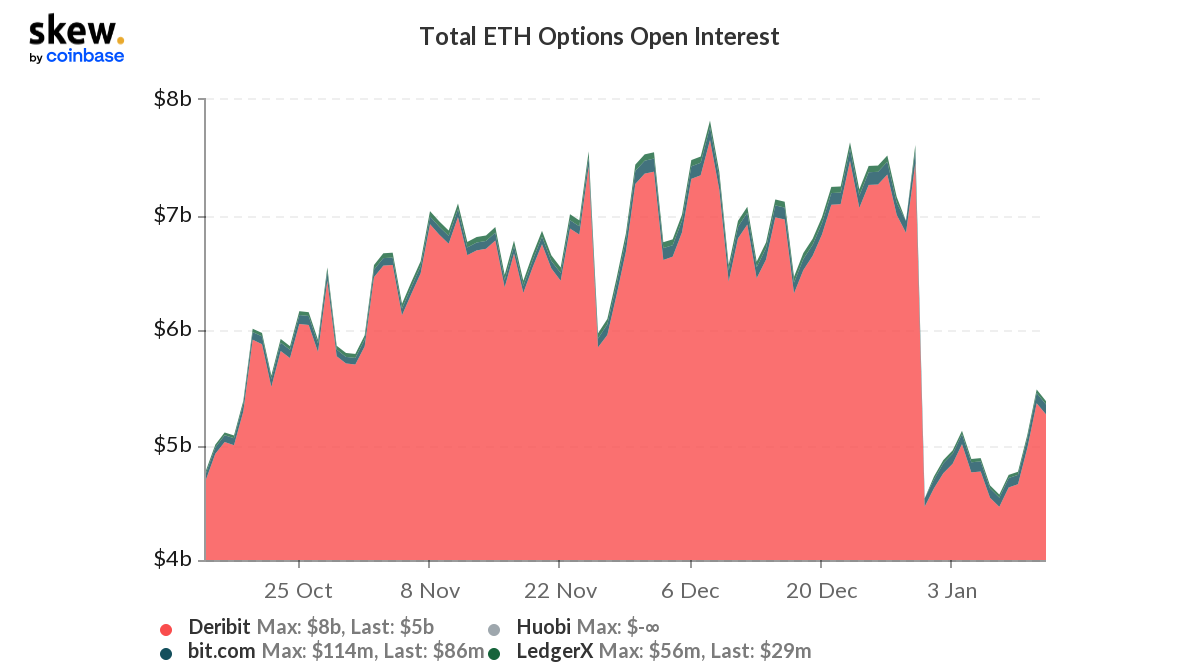

4. Options open interest on bitcoin and ether are down to where they were in early October.

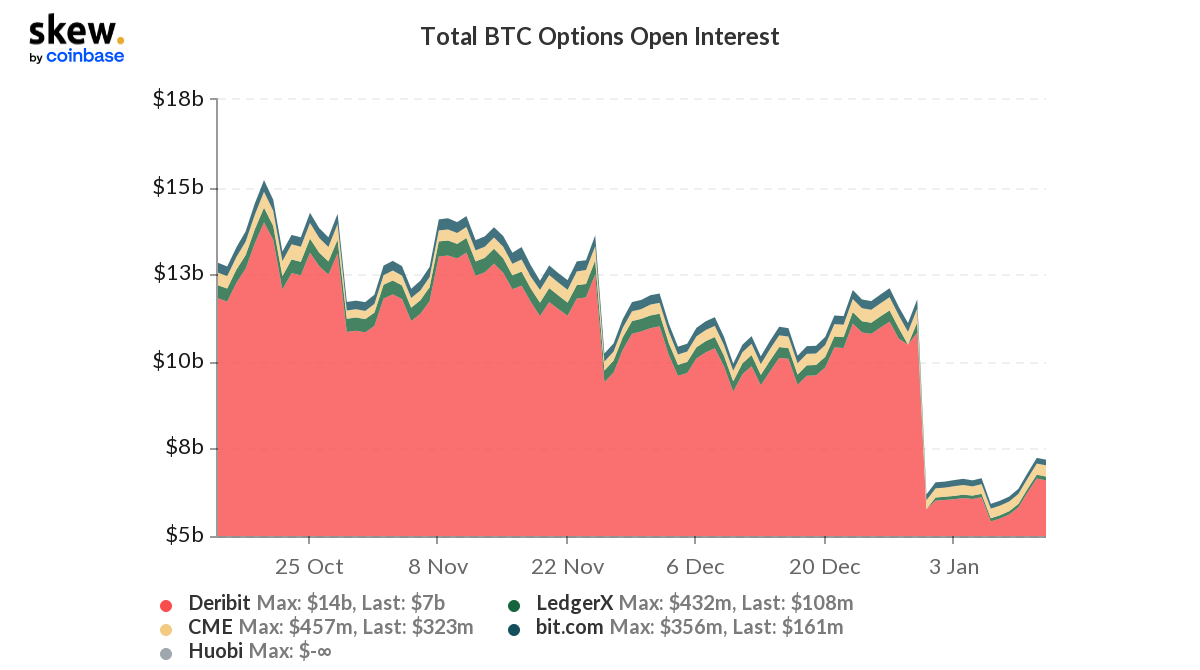

Bitcoin Options Open Interest (via Skew.com)

OI for bitcoin options is now at $7 billion and $5 billion for ether. Back in December, those figures were around north of $10 billion and $7 billion, respectively.

Ether Options Open Interest (via Skew.com)

Some of the falloff can be attributed to year-end bets taken throughout the course of 2021. While current OIs are still significantly larger for both cryptocurrencies than where they were last year, they are still roughly where things were in October, before the big run-up in prices.

By Lawrence Lewitinn

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!