Liquidity mining is dead, and trying to figure out the best way to replace it is the focus of one of crypto’s hottest subsectors.

The primary driver behind 2020’s “DeFi Summer” craze, liquidity mining refers to the practice of a protocol incentivizing user deposits with token rewards.

In recent months, however, liquidity mining has come under fire for being an imprecise incentivization tool often attracting mercenary farmers.

As a result, a range of novel new services such as bonds, time-weighted voting systems and DAO-to-DAO-focused stablecoin issuers have emerged to replace it – a broad range of advancements with the potential to permanently alter how DeFi protocols attract fresh deposits.

Depending on the project, the mechanics at play might be referred to as “liquidity as a service,” “protocol controlled value” or even “DeFi 2.0,” but in all instances, the basic principle is the same: to manage and direct vast sums of capital via incentive mechanisms.

These efforts are also united in that they attempt to answer a deceptively simple question: until now “free” money has been the animating factor behind DeFi adoption. What’s a more precise approach?

As the new year gets underway, projects working on solving this quandary are some of the most popular among traders and investors. In spite of a broader market rout, protocols focused on channeling liquidity are catching a healthy bid.

According to some, the trend is part of a broader one in Web 3, where value can be harnessed and commodified much like information on the internet.

“Liquidity is king,” Fei Protocol co-founder Joey Santoro told CoinDesk in an interview. “The way I frame it is that the internet is commanded by services and storage for information – cloud compute and data storage. When you translate that to DeFi, you need value services – lending platforms and AMMs [automated market makers] – and you need value storage, and that’s liquidity management.”

Whoever controls liquidity controls DeFi.

Others, such as angel investment collective eGirl Capital’s pseudonymous Cryptocat, believe that the liquidity trade is a passing trend.

Regardless of whether liquidity as a service turns out to be a narrative fad enjoying a temporary pump in crypto’s notoriously fickle attention economy or a new bedrock of on-chain market structure, at the moment at least, the arms race to control the flow of deposits in DeFi is, in essence, a battle over large swaths of the $230 billion sector itself.

“Liquidity is one of the two most important resources in this new world, and whoever controls liquidity controls DeFi,” said Santoro.

Liquidity mining

From the perspective of protocols looking to bootstrap usage, at first liquidity mining seemed like the future of how projects would find product-market fit.

During 2020’s DeFi Summer, Compound kicked off the craze by bolstering the returns on deposits to its lending platform with COMP token rewards, and protocols like Sushi managed to briefly overtake rival Uniswap on the back of similar incentive programs.

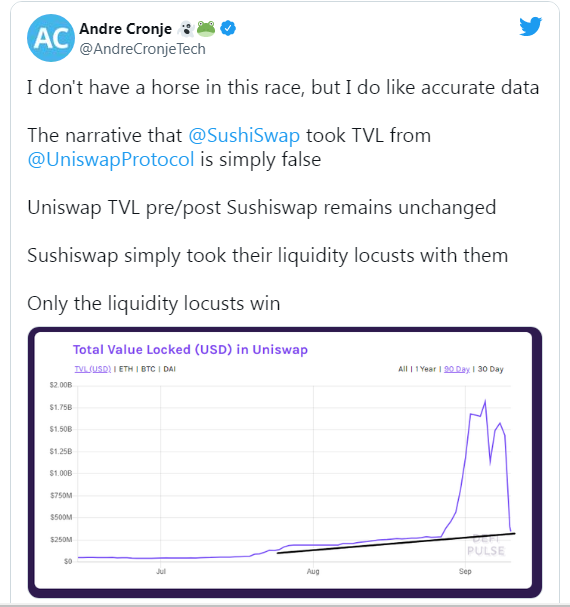

Critics, however, have recently pointed out that while directing a fire hose of rewards at users will certainly incentivize deposits in the short term, liquidity mining is an imperfect tool that also attracts what prolific DeFi developer Andre Cronje has referred to as “liquidity locusts” – temporary “farmers” who take their rewards and leave for the next geyser of tokens when the current one runs dry.

“I think liquidity mining is one of the dumbest things happening right now in crypto,” said pseudonymous Deribit Insights researcher Hasu on a recent podcast. “Why? Because, for me, there is absolutely no strategic thinking behind it. You should start from thinking, ‘What do we want out of this? What’s some kind of target liquidity we want in our protocol?’ And once you reach it, there should be no further rewards.”

Core users

By contrast, the new crop of projects harnessing liquidity aims to make payoffs more transparent. They seek to measure how many dollars in token rewards a protocol is paying in order to attract how many dollars in deposits. In some cases, they’re actually putting a protocol’s liquidity under a DAO’s direct control.

One of the first of these alternatives emerged almost by accident.

Automated market maker Curve introduced a “vote locking” feature in August 2020. This allowed CRV holders to lock their tokens in exchange for veCRV (voting escrow CRV) for up to four years. VeCRV in turn grants the ability to vote on which liquidity pools received a boost to CRV reward emissions, with voting power weighted in favor of those who locked their tokens for longer time periods.

At the time, it appeared as if it were a tool for individual farmers to maximize their returns: By locking a portion of their CRV rewards, they could direct even more rewards to their favorite pools and secure greater profitability in the long run.

Instead, however, other protocols have proven to be the primary benefactors of this system rather than individual farmers, with a race underway to accumulate CRV in what many have labeled the “Curve Wars.”

According to one analyst who spoke on the condition of anonymity, this vote-locking system – also referred to as “venomics” – “pretends to select for time preference, but in reality actually centralizes governance on whoever can accumulate the most tokens.”

In short, whoever accumulates the most veCRV controls CRV rewards emissions.

Right now the “kingmaker” protocol in control of Curve’s rewards is Convex Finance. Convex has hoovered a stunning 43% of all circulating CRV, and Convex’s governance token, CVX, accounts for 5.1 CRV in voting power per token, according to a Dune Analytics dashboard.

Curve and Convex are also the two largest protocols in DeFi, commanding a combined $40 billion in deposits, per DefiLlama.

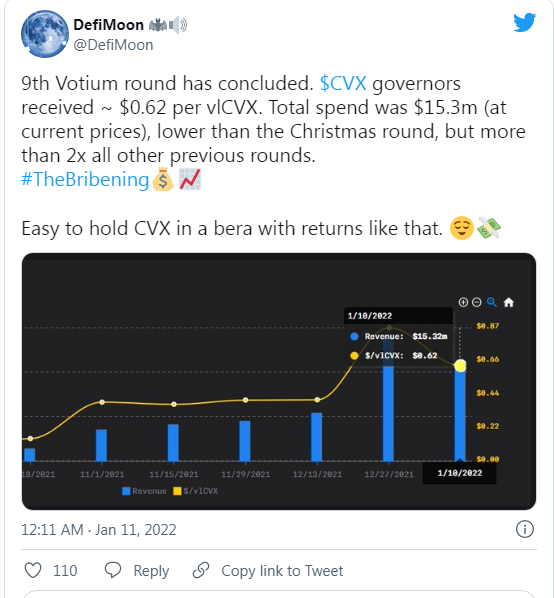

As a result, a cottage industry has emerged where protocols use platforms like Votium – an interface built on top of Convex – to “bribe” vote-escrowed CVX holders to direct liquidity to pools that are important to them.

“Bribing” for deposits has clear benefits for protocols.

For instance, in the case of a stablecoin like Terra’s UST, deposits in Curve pools help UST ensure healthy, liquid markets, aid in UST remaining pegged to a dollar and create utility for the stablecoin – achieving all the goals a liquidity mining program might but with much more transparent costs, payoffs and goals.

Indeed, in a recent governance forum post, a UST stablecoin team member concluded that the protocol’s ongoing programs to incentivize deposits via CVX bribes and accumulate CVX are “going extremely well.”

They want to get bribed as much as the next guy, so here we are.

The benefits mean that venomics might be here to stay, according to some.

“Say you’re a stablecoin. The number one thing for stablecoins is building liquidity,” said Redacted founder 0xSami in an interview with CoinDesk. “It makes sense for you to go and acquire Convex, if you want derivatives liquidity you should go acquire Ribbon’s voting escrow token, Sushi for DEX liquidity, or Aave so you can become collateral for lending. This is going to be a big trend this year.”

Bribe ecosystem

On the heels of the emerging bribe economy, a number of new products are coming to market that serve as governance or voting middleware in an evolving tech stack devoted to helping protocols route and control liquidity: Warden, Bribe, Llama Airforce, Votium and Votemak.

Votemak was recently acquired by Redacted, and Bribe closed a funding round in recent weeks.

Part of this proliferation is the result of other projects implementing variations on venomics, creating a clear need for more marketplaces where protocols can buy votes.

Tokemak is one such project. The protocol is aiming to become a decentralized market maker: users deposit funds and receive TOKE token rewards, which can be used to vote on where liquidity is deployed. As a result, Tokemak is now another target for protocols looking to direct liquidity via bribes, and other projects – such as Frax and Yearn – have introduced venomic models as well.

“[The] retail audience immediately understands what we’re doing and the importance of it. They want to get bribed as much as the next guy, so here we are,” said Bribe’s pseudonymous founder, Condorcet, in an interview with CoinDesk. Tokemak will be one of Bribe’s initial integrations.

The emerging sector has, unsurprisingly, also caught the eye of venture capital investors.

“We think it’s an interesting trend,” said Dragonfly Capital’s Ashwin Ramachandran, one of the participants in Bribe’s recent round. “It’s definitely an order of magnitude increase in terms of capital efficiency and pricing as far as liquidity mining schemes, which can cause excessive sell pressure on native governance tokens.”

Token control

While some protocols are playing the bribe game in an effort to direct liquidity to favorable pools, others are vying to control the liquidity directly themselves – an emerging trend of “protocol-owned liquidity.”

Algorithmic stablecoin project Fei is working with Ondo Finance, a risk-tranching protocol focused on mitigating impermanent loss, to build a product that will allow protocols to pair native governance tokens from their treasuries with Fei’s stablecoin to directly create liquidity pools.

Instead of protocols blasting incentives at a pool to generate user deposits, this would allow protocols to create the pools directly – and, critically, also keep a portion of the trading fees from the pool, creating a new revenue stream.

This logic also applies to Olympus Pro, Olympus’ bond program. There, protocols exchange liquidity pool positions for bonds, once again allowing protocols to control the liquidity of their token, as well as earn the trading fees.

Santoro, the Fei founder, said in an interview that this is part of an emerging sector of “direct-to-DAO” services where third parties help DAOs more efficiently bootstrap liquidity for their tokens, among other needs.

Protocol-owned liquidity is also becoming a kind of vertical unto itself. Olympus and its various forks, including protocols such as Wonderland and Redacted, have accumulated large sums of CVX and other tokens with bribe earnings potential – treasuries that founders argue can now be used to generate returns.

In a recent Tweet, Wonderland developer Daniele Sestagalli wrote that the protocol was moving away from Olympus’ much-maligned high APY scheme.

Redacted’s 0xSami, meanwhile, told CoinDesk that he envisions the protocol becoming a “meta governance token” that will enable projects to come to a single asset, in this case Redacted’s BTRFLY, and hold sway in multiple governance processes. The treasury would earn fees for this service, and the fees could be distributed via a debenture bond or similar financial instrument.

“Obviously we need the high APY for a competitive edge right now, but once the treasury has been established the token doesn’t even have to rebase at that point – we can introduce a project with sustainable returns,” he said.

This bait-and-switch from a high APY money game to a revenue-generating treasury has been the target of ire over the last few weeks as Olympus and its various forks have been crippled by lowering prices:

Indeed, in what may be the first example of “quantitative easing” by a DeFi project, Wonderland conducted a major buyback using its treasury on Tuesday – a sign that the OHM forks are beginning to leverage their considerable treasuries.

Layer 2 expansion

Curiously, until recently, much of the experimentation in liquidity as a service had been concentrated on Ethereum. Multiple alternative layer 1s currently have incentive programs running but are using classic liquidity mining tools – an inefficiency ripe for disruption.

“I think you’re going to see the exact same two narratives play out – emissions farming becoming protocol-owned liquidity,” Santoro said of incentive programs on Ethereum alternatives.

Being able to allocate your tokens to the future growth of the platform, that’s an extremely powerful concept.

Indeed, protocols deploying venomics are beginning to emerge in other ecosystems. Cronje and Sestagalli are collaborating on an unreleased Fantom-based project currently being referred to as ve(3,3) – a mashup of the shorthand for venomics and Olympus’ staking program.

The unreleased project is already showing signs of tremendous popularity. One project that was released on Tuesday, veDAO, aiming to claim a controlling stake in Cronje and Sestagalli’s new protocol, reached over $785 million in total value locked in just hours.

Santoro, meanwhile, says Fei is plotting to pick a layer 2 to migrate its ecosystem to, which he believes would immediately establish it as a leader with Fei’s alternatives to liquidity mining.

“We’re going to move together to whatever L2 we see fit, and we’re going to kingmake that L2. Who is going to be able to compete with a billion dollars in unincentivized TVL?” Santoro said.

Future play

While liquidity as a service is currently one of the fastest-growing sectors in crypto, not even those working in it know if it’s guaranteed to become the future of project bootstrapping.

Redacted’s 0xSami said that projects like Curve and Tokemak that are aiming to become central hubs of liquidity with their incentive programs will either win a majority of market share, or the trend will simply fizzle out.

“Either until one of them becomes the ultimate hub of liquidity for DeFi, or until the narrative gets exhausted. One or the other,” he said.

Some analysts have noted in recent weeks that while TVL is higher than ever, Curve’s percentage of stablecoin swap volume – a bedrock of its market share – has been slipping in recent weeks as low-fee Uniswap v3 pools encroach on Curve’s turf.

An analyst who spoke on the condition of anonymity also cast doubt on the venomic model winning out, saying ve-tokens aren’t “optimizing for the right things,” but “liquid governance and control of emissions are incredible.”

“That’s Curve’s greatest gift to the DeFi ecosystem – being able to allocate your tokens to the future growth of the platform in the form of liquidity emissions, that’s an extremely powerful concept,” he said.

Fei’s Santoro, meanwhile, believes the outcome won’t be a monolithic winner, but instead a world with multiple competing allied projects commanding vast swaths of liquidity.

“I don’t think it’ll be a monopoly, but a bunch of competing ecosystems.” he said. “It’s part of the whole consolidation narrative. You’re going to see the Tokemaks, Olympuses, Tribe DAOs, Curves of the world suck up liquidity and control. The DAOs that align [with them] will benefit from that.”

Even with the outcome uncertain, the current crop of projects emerging in the wake of the heady days liquidity mining nevertheless represent a progression in how projects entice and incentivize deposits from users and DAOs – even if venomics is a misdirection, tools like bonds and protocol-owned liquidity are likely here to stay.

“I’m bullish on the experimentation,” Santoro concluded.

By Andrew Thurman

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!